Surgent's Section 754 Step-Up in Basis: Understanding the Tax Issues for Partnerships and LLCs | ASCPA

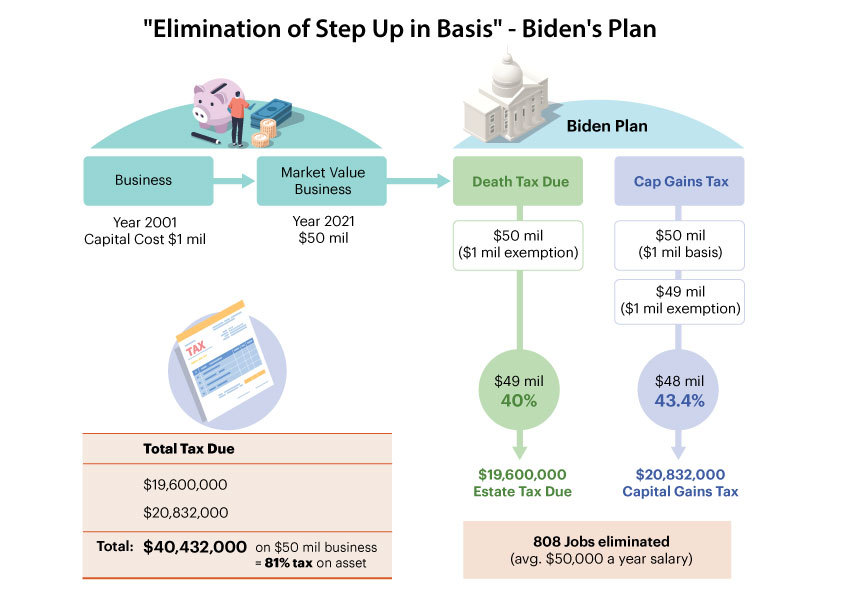

Biden Tax Plan May Leave Estate Tax Alone, But Kill 'Step Up' Provision - Insurance News | InsuranceNewsNet

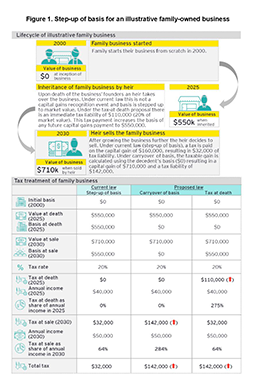

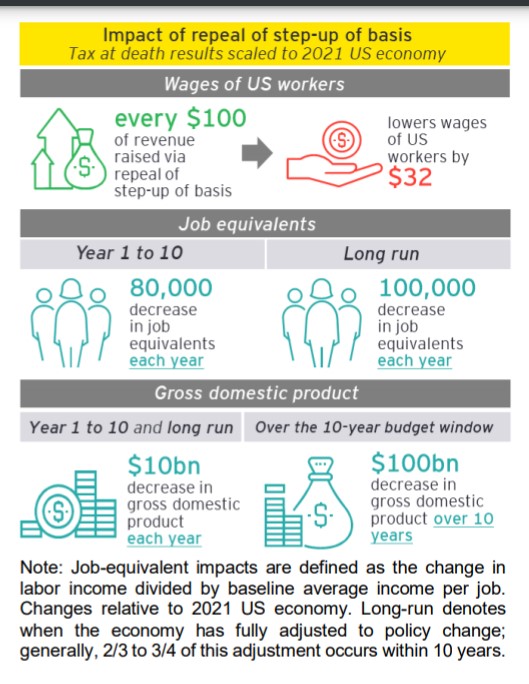

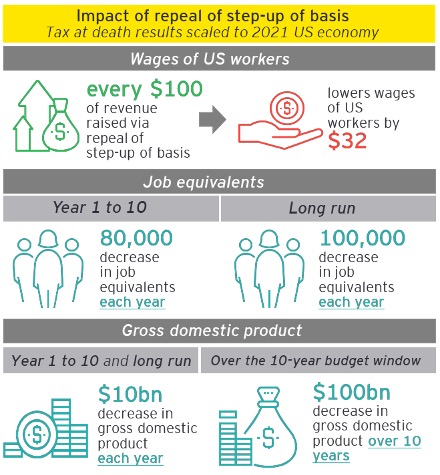

Repealing step-up of basis on inherited assets: Macroeconomic impacts and effects on illustrative family businesses

STUDY: Dems' Supercharged Second Death Tax Kills at Least 800,000 Jobs, Slashes Paychecks - House Committee on Ways and Means