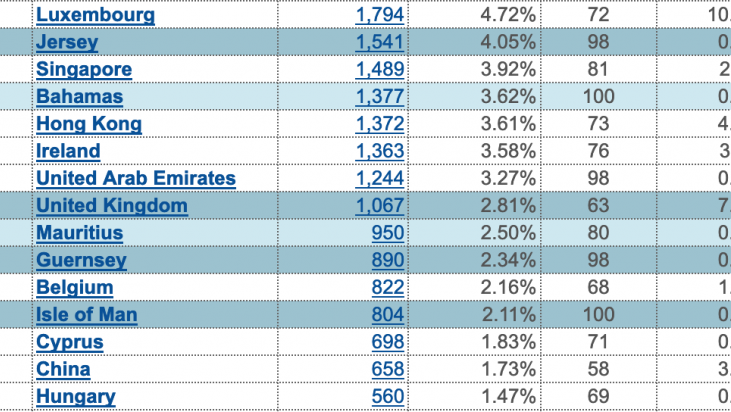

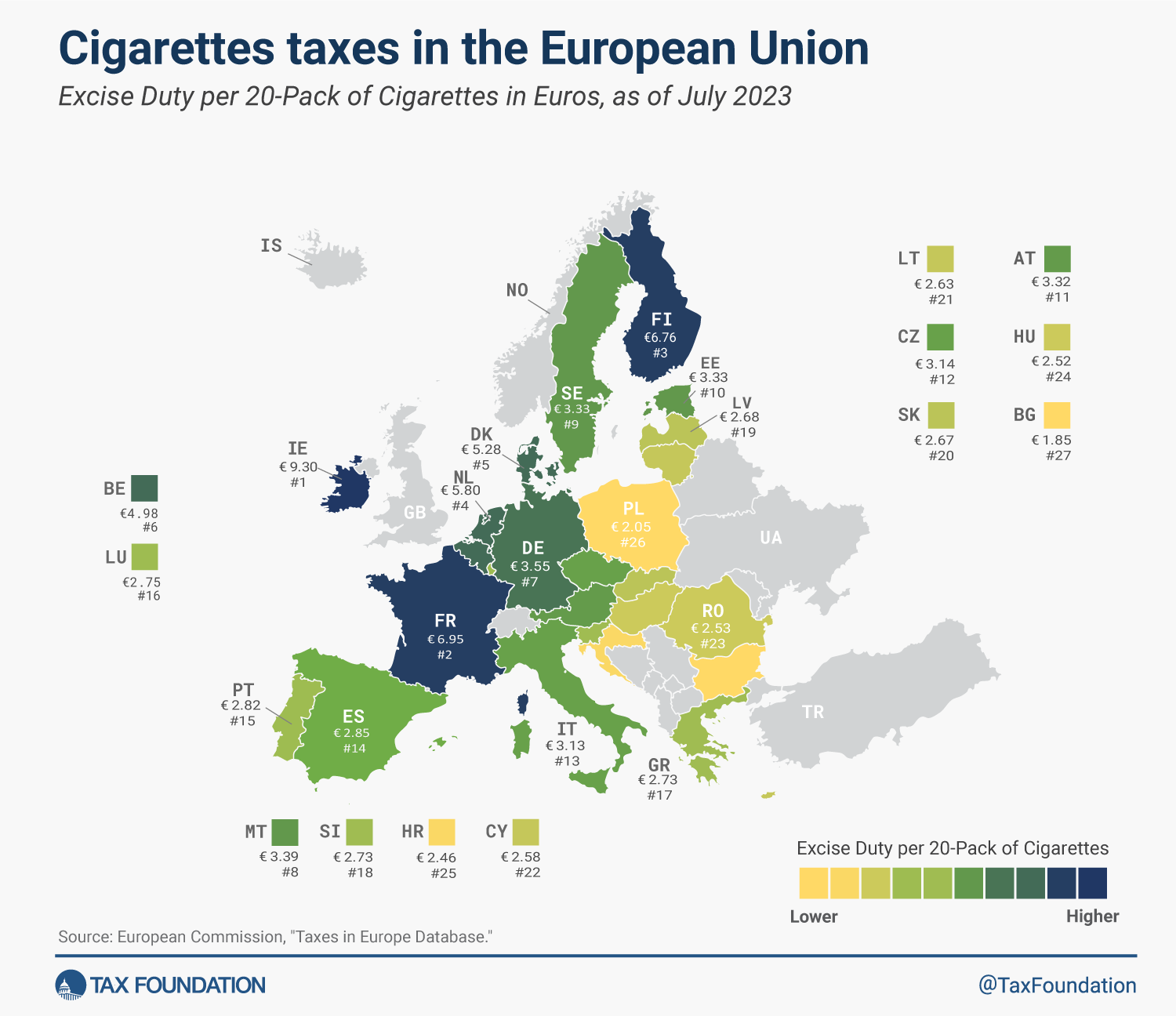

Tax revenue shared by countries with withholding tax regime (2010, € million) | Epthinktank | European Parliament

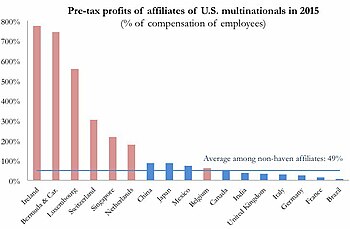

Luxembourg Publishes Synthesized Text of Tax Treaty with Jersey as Impacted by the BEPS MLI — Orbitax Tax News & Alerts

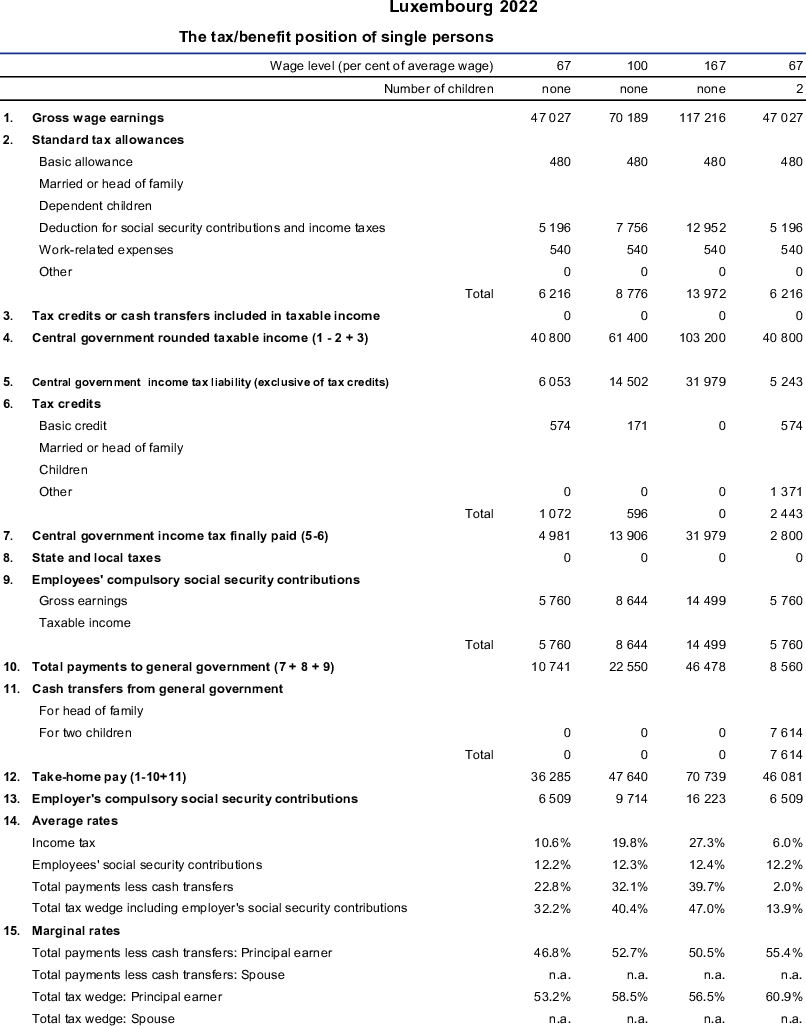

Luxembourg | Taxing Wages 2023 : Indexation of Labour Taxation and Benefits in OECD Countries | OECD iLibrary

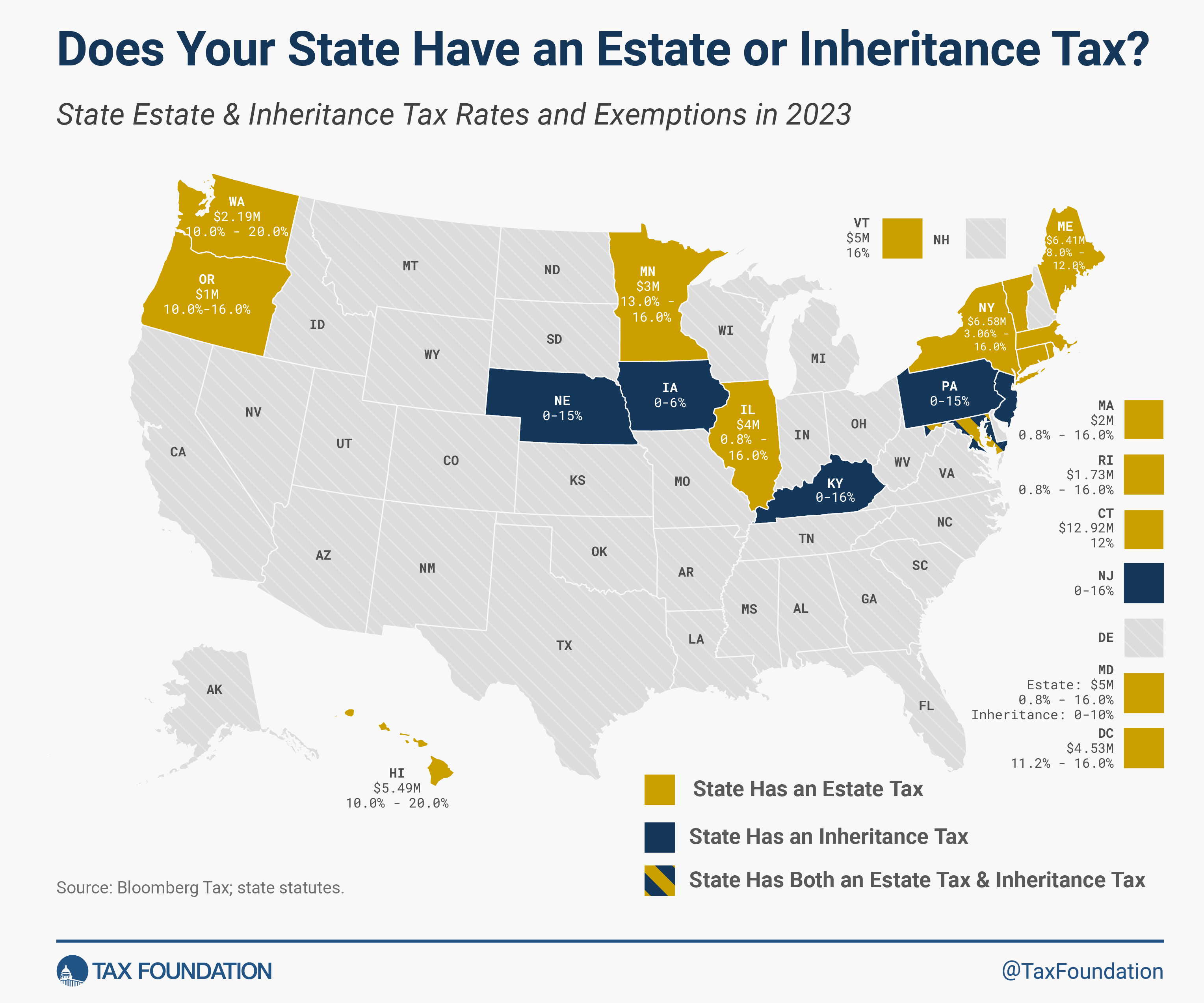

Boost Worker Pay – and Make the United States More Competitive – by Gutting the Corporate Income Tax | International Liberty

With almost two-thirds of Australia's top 100 companies listed on the stock exchange have subsidiaries in tax havens or low-tax jurisdictions, there are fears the structures are being used to minimise tax

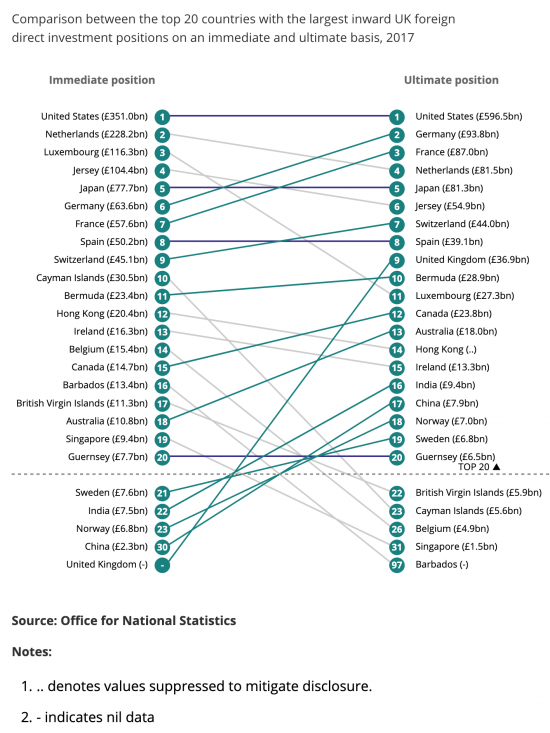

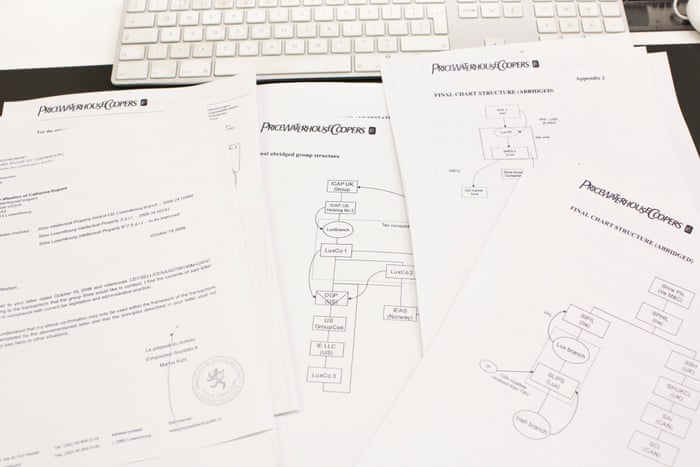

Luxembourg tax files: how tiny state rubber-stamped tax avoidance on an industrial scale | Tax avoidance | The Guardian